So I’m looking to buy in six months, and my KiwiSaver has taken a hit thanks to Coronavirus. Should I change to a Conservative fund or ride it out? Previously I would ride it out and made up my loses. I don’t really want to go conservative as that would be locking in a loss, but I also can’t afford it to keep sliding!! Haaaaalp, sincerely your non financial savvy friend

Normally when I am speaking to someone about what to/ how to KiwiSaver, I would advise to align your fund / portfolio mix to your investment horizon. Well, what does that mean? Simply, just making sure that your investments are structured to meet your needs when and if you need to.

- For example a 10 year plus horizon, such as investing for your retirement could look like putting your money into high growth or aggressive investments (property & equity shares most likely).

- A horizon of three to 10 years, you would prefer a more moderate, balanced approach (mix of property, shares, and cash/ term deposits to reduce the risk of losing in a downturn).

- And a short one to two year horizon (such as saving for your first home), you will more than likely want a conservative set up (mainly cash/ term deposits investments, with a little bit of property or equity shares to capture some growth hopefully).

When I was looking to buy a first house, my approach was to shift 80% of my KiwiSaver to conservative funds, and 20% between balanced, growth, or equity funds. Anywhere between 12 – 24 months prior to purchasing is generally a good time to think about changing your allocation, but life sometimes moves a lot faster than this. So when you know you want to access it, that is normally the best time to change. You won’t get the big ups in the meantime, but you also don’t get the big slips. Protecting the value of your KiwiSaver is the priority now, so there is increased certainty about how much from KiwiSaver can be accessed for a deposit.

So then what? It would be a good time ideally to change now to protect against future slips. However, most medical/ pandemic related events that impact stock markets are short lived. Normally experience 10-12% decreases in first 6 months (we are in about mth 3ish of Corona and NZX has lost about 8-10% atm I think). Could be another 5% loss over the next 3-4 mths if history is anything to go by. Also, in the 12mths after a medical event, stocks rebound more than the losses, up to the likes of a 30% gain (because people eventually realise that there wasn’t a real long-term threat, it was mostly irrational fear, and that the world goes round). They reckon a corona vaccine is about 12 mths and $3b away, so we could see a similar pattern emerge from the markets relating to Corona virus as has been the case for other pandemics.

The next point I would like to make is related to the age old question, when is the best time to buy a house? Now is always the answer. The secret is buying the “right” house. Most buy badly. You can’t time markets, but as with most investments time in the market is the key to success. So if you buy well, it won’t matter what the market is doing in the short term. I say this because I wouldn’t 100% suggest that you must wait 12 – 24mths to ride out and recover your loss in Kiwisaver. You can, but you might miss out on buying a good property today that will house you and provide value until then.

If you took a larger view of stocks in the last year or more, you will see the NZX increased over 20% by the time Corona dropped it to its knees. However it is still up today over 10% from last March. Pretty good returns compared to 1% bank deposits if you ask me. If you take a bigger look at your funds, it will still paint a rosy picture and a good return on your investment so far (just not as much as it was 2 weeks ago). So, don’t feel too disheartened by the short sharp decline, it’s not as bad as it may seem.

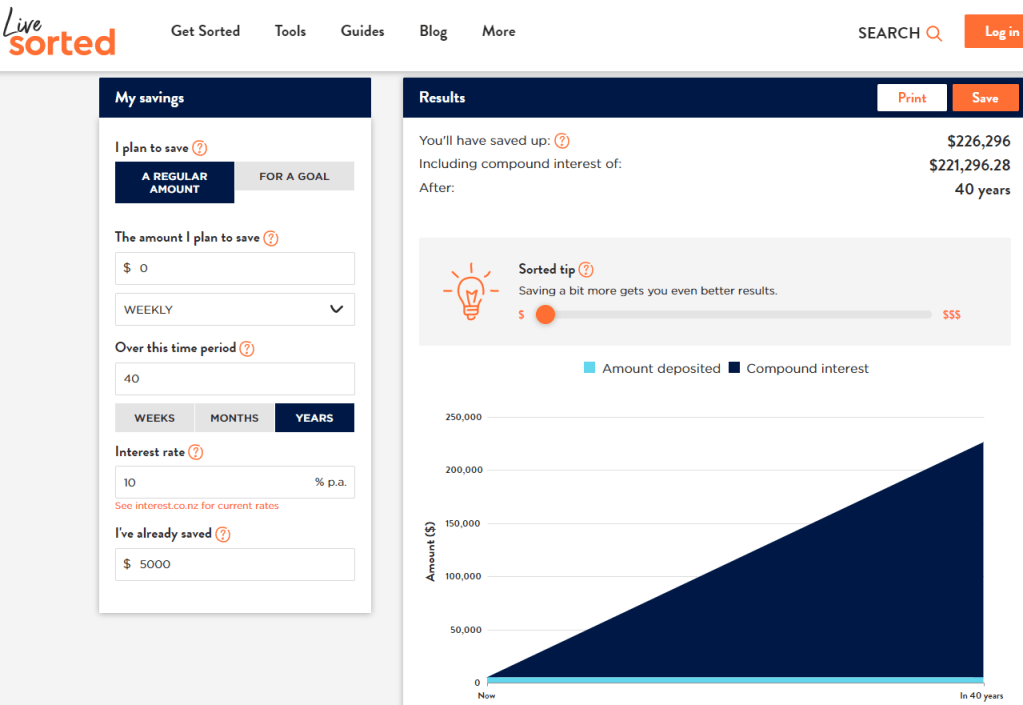

And lastly, consider whether you need to use all your KiwiSaver or not. This comes back to buying well. Your balance might seem like a big or small amount to you today, but if you consider how much that withdrawal will cost you in retirement, it’s mere chump change. For example, taking out $5,000 today can cost you retirement savings of $222,000 in 40 years. This is assuming the market grows on average 10% – which it has done so for the last 20 odd years. That equals an extra $97,000, after adjusting for inflation in today’s dollar value. So, you should not be thinking “I’m putting $5,000 towards my house from my KiwiSaver”, but rather “I’m putting $5000 against my house today and losing out on $97,000 for my retirement today”. Yes, there will also be increases in house values that will provide for your retirement most likely, and there are many other good reasons to buy a house using KiwiSaver, but it is important to know what you are sacrificing as your house value won’t increase 20 times over like your KiwiSaver fund has the potential to. At the end of the day it is a trade off.

This is something that is a hard concept for most to understand, and quite honestly most Kiwi’s don’t want to know about. It is known as “opportunity cost”, which by the Google definition is “the loss of other alternatives when one alternative is chosen.” Sounds airy fairy just reading the definition let alone thinking about it in a practical real life situation. But it is good to keep in mind. There is no right and wrong answer here, but I believe if we can educate NZer’s on all the impacts of withdrawing KiwiSaver, everyday Kiwi’s can much more comfortably make decisions and plans for their future today.

Remember your cold & flu tablets people,

the_budget_investor

I have included two links below to resources that I find incredibly useful and relevant in answering the question.

First is the Sorted.co.nz Savings Calculator. This was used to calculate the “alternative” investment for retirement lost when withdrawing $5,000 from KiwiSaver today (pictured above). There are many other excellent tools on the Sorted website so please do have a look around.

Secondly is an opinion piece from Sam Stubbs – founder of Simplicity KiwiSaver. With the current climate of media hype and build up, Sam provides somewhat a voice of reason against the noise and panic being pushed down on us.

Next post out Wednesday the 18th.