Yes! The big, scary B word. At some point we have all tried to implement a Budget in our lives for one reason or another, and the habit just never seems to stick or even be effective for the majority of us. So what is it? Are we all just mentally weak, lacking the true will power to get ahead financially? Or is Budgeting just some con at large to distract us from the reality that we will never be any better off than we currently are?

Even I, with a strong background in math, statistics, economics, accounting & finance, have tried and failed multiple times to “Budget” for a goal or more simply to make it from paycheck to paycheck. What I never quite grasped a hold of is “Why am I budgeting / What is my Why?” and “How does this help me achieve my overall goals / how does this help me live my current day to day lifestyle?”. I think these questions are key in being a successful investor, but for now lets take it back a step.

What is a Budget? As per Google, Budgeting means –

noun

- an estimate of income and expenditure for a set period of time.

- “keep within the household budget”

In my opinion, this definition is the catalyst for why we get it wrong when we think about budgeting. Right from the outset, a Budget is defined and thought of as some form of constraint. A pre-defined set of limits to keep within, or else a sense of failure. Such as “keep[ing] within the household budget”.

Every time I have failed to Budget, it is 100% because I have failed to plan my budget properly. I would keep within my limits, right up until I couldn’t. And once that feeling of failure sets in, all is loss, thus ending our faith in the magic of Budgeting. I can remember a time when I use to count every penny, I was saving $5 a week for a concert ticket later in the year. One punctured & shredded tire later saw the swift end to that. I had to dip into my savings and could no longer afford the ticket price. It would have taken a mere $10 a week for a few more months, but I simply couldn’t afford it with my current level of income, and that’s where I gave up. My budget no longer allowed for it, so it was cut from the list of expenses. I’m sure we all know the feeling, most of us are constrained in one way or another, and this quite often leads to our budgeting failures before we have even begun.

So why is budgeting so hard? Well, we budget backwards. We start off with our constraints (usually the amount of weekly income we may earn) and then try to fit as much as possible into those limits. Inevitably, some things are not going to make the final cut unless you are as disciplined as a monk. To be honest though, it’s not that bad of a place to start, still better than not having a Budget at all, it’s just not a very flexible option if it gives us an unfavorable answer – spend less than X or else! Life is never straight forward though, you can have all the best planning in the world, and something will still step out of line.

We predominantly use our left brain when it comes to Budgeting, which performs tasks that have to do with logic, such as in science and mathematics. So this makes a lot of sense to start with as it will lay the foundations of our Budget. For example, if I have $500 of income, and $300 of expense, I have $200 left over.

What normally doesn’t get engaged as much throughout the process is the right side, which performs tasks that have do with creativity and the arts. For example if I have $300 of Income, and $500 of expenses, I am short $200. I have $150 of expenses on luxuries that I can cut back on, but still $50 shy of what I need! I do however have a large garden full of food and flowers all year long. What if I sold $75 of food and flowers at the Sunday market every week? I’m now saving $25 a week, yay!

Now it’s not always that easy, but it illustrates the impact the right side of the brain has complimenting the left. A lot of people are using side hustles these days in order to earn a few extra dollars, so I think the concept is not too foreign to understand, but this is such a great example of people stepping outside of the box to achieve their financial goals. You don’t need a Budget to do this, but one might highlight if you need a higher level or income or an opportunity is there to fast track your savings.

With all that being said, I would rather define Budgeting as –

noun

- an estimate of expenditure for a set period of time AND DEVELOPING A PLAN to generate income in excess of expenses.

These days I am no longer constrained by my income to live day by day. It does limit my ability to grow wealth, which is now my focus, so I spend a lot of time brainstorming and planning how best to use my leftover savings. Notice how this is starting to sound less like your typical “household budget” and more like something that would be called “financial planning”.

Well, essentially, they are one and the same, they just invoke a very different feeling inside when you say them. One sounds like a boring, constrained chore you must do every week. The other sounds more like a forward looking, proactive task that will benefit you greatly in the future. I’ll let you decide which is which, but in reality they both achieve the same outcomes, getting ahead financially.

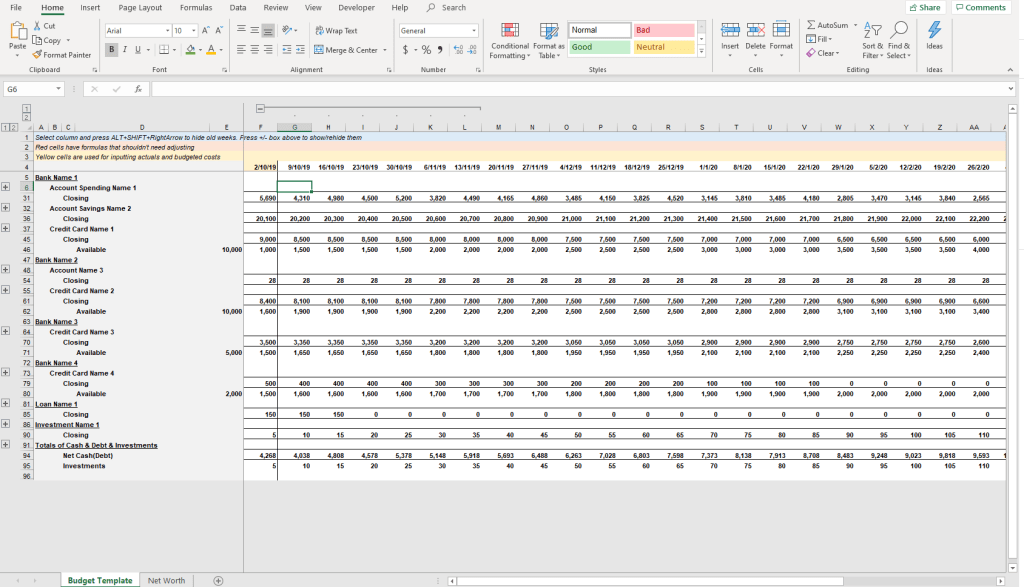

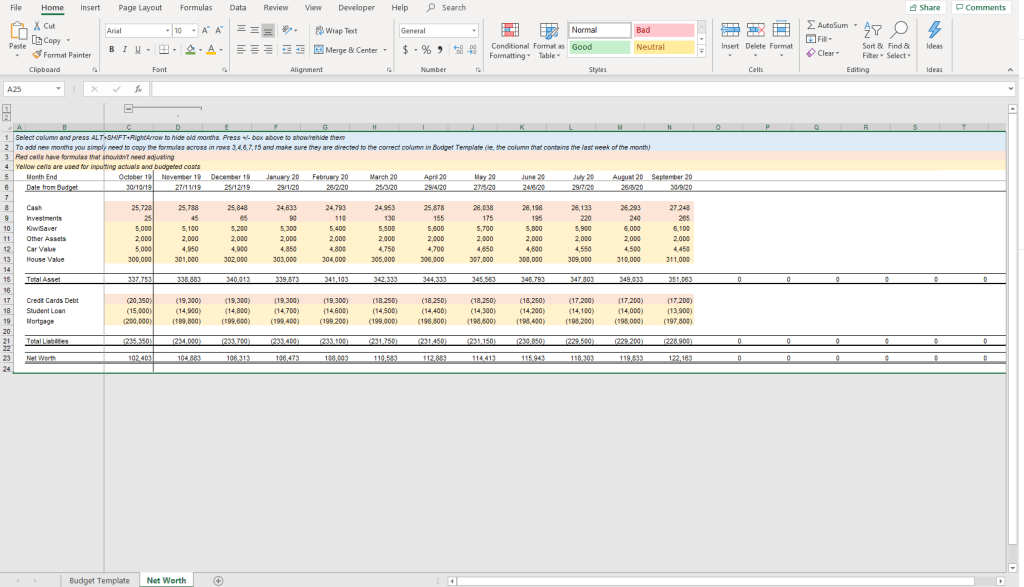

I’m very nerdy and I love numbers. Right now I could tell you how much I plan to spend, on what items, for every week, covering the next 12 – 18 months, and I update this weekly. Wow, intense right? Don’t worry, not every wants or needs such a detailed budget. For most people, just looking out 1 – 3 months will be enough. Life changes so fast that looking beyond this is not all that useful. And it can be as detailed, complex, or simple as you like.

If I was to summarise my approach to Budgeting –

- Understand your expenses first! This is the key. What are you spending all your money on. Try recording a weeks worth, and stretch that out for a month (4 weeks) if you can.

- Is it a pretty picture? Do you need to be spending on everything you have done in the last month. Totally fine if you do. Just highlighting that this is the best time to identify those daily coffees, or 100’s of shoe purchases that don’t help you put food on the table or that next family holiday.

- Now calculate your income. Note how this is not the first or second step. You can think of these first three steps as your order of priority for your left brain to focus on.

- Whats left (or not)? Do you need to find that extra income to pay for everything you need to? Now’s the time to engage your right brain. Is there more hours at work you can pick up, a side hustle, can you delay that holiday 1 month for when flights and accommodation are cheaper? If you do have extra surplus, do you put it in A) emergency savings, B) regular savings, C) invest for the long term? There is almost always a solution, sometimes we do have to cut spending, but I would like you to challenge yourself, seek out others for ideas on what you could do to increase your income or be able to afford what you want.

- Check in to check out. For the most part you are done with your budget now. Sit back and let the plan come to life. You will only need to tweak it a little bit for when things are not accurate each week. The importance of this relates back to step 1 – understanding your expenses. Things change over time, so if you update your budget as you go it will be more accurate and hopefully avoid those shock expenses.

- And for when those unexpected expenses arise, just pop back to step 4. It might sound over simplified to do so, but once you train your brain to think about your budget like this it should start to feel a lot easier. You might even realise you do a lot of this in your head already, and formalising it in an excel spreadsheet might help ease your mind and stress during the week, or open up new options and ideas you couldn’t see before.

Hopefully this has left you with a less conventional view on budgeting. 80% of the advice out there is focused around the nitty, gritty details of setting a budget and sticking to it, with only 20% focused on why you should set a budget and focusing on outcomes instead of inputs. I personally, and I think this shows in the above post, try to focus 80% of my thoughts around why am I budgeting, what am I trying to achieve, what are my goals, and then 20% on the how will I achieve this in the detail of a budget.

I actually have found writing about this topic more difficult than I anticipated. I very much am a detail person, and there is a huge depth of detail built into my budget, but most of it has all been driven from my need to brainstorm and problem solve ideas relating to my financial goals.

So, until the sun rises 7 more times, ciao. the_budget_investor

Next post Wednesday 25th